The MIRR is calculated by incorporating the longer term worth of constructive cash flows and the present value of money flows taken at totally different discount charges. It assumes that every one cash flows are reinvested on the terminal price till the end of the project. Nevertheless, realistically, such opportunities could not exist, or they will not be as worthwhile as assumed. Subsequently, the MIRR could overstate the future modified internal rate of return price of the money flows generated by the funding, leading to overly optimistic results.

CFI is the worldwide institution behind the monetary modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anybody to be a fantastic monetary analyst and have a great profession path. In order that can assist you advance your profession, CFI has compiled many sources to help you along the path.

Mirr Information

For example, if the project A has a life of 5 years and a MIRR of 15%, and project B has a lifetime of 10 years and a MIRR of 12%, it is probably not clear which project is better. Project A has a better MIRR, but project B has a longer life and will generate more total cash flows. Equally, if project C has a MIRR of 10% and an preliminary funding of $1,000, and project D has a MIRR of 8% and an initial funding of $10,000, it is most likely not obvious which project is more worthwhile. Project C has a better MIRR, however project D has a bigger scale and may create extra value. To fix the last two issues above related to IRR, a special calculation was created. The MIRR makes use of plenty of related ideas as IRR, but there are slight differences to assist improve the original formula.

- Due To This Fact, the MIRR might overstate the longer term value of the money flows generated by the investment, resulting in overly optimistic results.

- Subsequently, we advocate that investors and managers embrace MIRR as a better different to IRR for evaluating investment projects.

- It is contingent upon the money flows of the investment, the reinvestment fee, financing value, and the financial context in which the analysis is being applied.

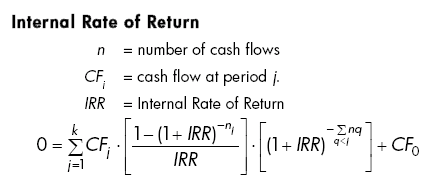

Step 2: Present Value Of Cash Inflows

For example, if the project has two money flows of $100 every, one received at the finish of yr 1 and the opposite received at the end of yr 10, MIRR treats them as equal. Nonetheless, the present value of the first money move is far larger than the current worth of the second money circulate, which should be mirrored in the project analysis. Divide the terminal value of the positive money flows by the current value of the negative money flows. Determine the cash flows of the project, including the preliminary funding and the future returns. The IRR may have multiple value for tasks with non-conventional cash flows, similar to these with adverse cash flows in the center.

However, a better and extra https://www.personal-accounting.org/ realistic measure known as the Modified Internal Rate of Return (MIRR) improves the traditional IRR by addressing one of its core assumptions. This article will cowl calculating the Modified Inside Rate of Return or MIRR, clarify the means it differs from IRR, and show the steps using a real-life enterprise case. MIRR calculates the current worth of the terminal worth of the project, which is the sum of the future values of all cash flows. However, this does not replicate the time value of cash, which implies that cash flows received earlier are more useful than cash flows acquired later.

By incorporating these components into the analysis, MIRR enables better-informed decision-making, resulting in more efficient allocation of assets and enhanced portfolio performance. MIRR, or modified inside price of return, is a variation of the IRR metric. Equally, it shows you what return (expressed as a proportion of the preliminary investment) you’ll find a way to expect on a given project.

While MIRR presents a extra comprehensive evaluation of investment alternatives, its implementation can pose challenges for traders. Calculating MIRR requires a thorough understanding of financial ideas and the ability to accurately estimate the cost of capital and reinvestment rates. Whereas MIRR provides several benefits, buyers should additionally concentrate on its limitations. The choice of appropriate finance and reinvestment charges can considerably influence the calculated MIRR, necessitating cautious consideration and evaluation. Furthermore, like several financial metric, MIRR should not be used in isolation however rather as part of a complete funding analysis technique. Modified Inner Rate of Return (MIRR) allows for the handling of a number of cash inflows and outflows by changing the assumed fee of reinvested growth from stage to stage in a project.

Modified Inner Rate of Return presents an correct and dependable estimate of the ROI investors can anticipate. As the method is quite complicated, we strongly suggest using our MIRR calculator instead of figuring out its worth by hand. Open the part referred to as « Enter extra annual cash flows » to enter up to 9 years value of money flows. The frequent view is that the MIRR provides a extra realistic picture of the return on the investment project relative to the usual IRR. Conversely, it is not really helpful to undertake a project if its MIRR is lower than the expected return. In addition, the MIRR is often employed to check a quantity of alternative tasks that are mutually unique.

It can be a more prudent alternative when a project’s money flows are important and are reinvested at a rate totally different to the cost of capital. MIRR, like any other monetary evaluation software, has its limitations and weaknesses. In abstract, MIRR serves as a priceless software for evaluating investment opportunities, comparing various projects, and making sound funding decisions that align with investors’ goals and threat preferences. MIRR helps investors and analysts consider the true profitability of investments, considering the opportunity price of capital and the actual reinvestment alternatives available.

Subsequently, we recommend that traders and managers embrace MIRR as a greater different to IRR for evaluating funding tasks. In this blog, we’ve mentioned the limitations of the interior fee of return (IRR) as a criterion for evaluating funding initiatives and proposed the modified inside fee of return (MIRR) as a greater alternative. MIRR is a extra sensible and constant measure of profitability that overcomes the problems of multiple IRRs, scale variations, and reinvestment price assumptions.