To learn more, come across Setting 3468, Funding Borrowing (and its particular instructions), and Interior Money Code part 170(f)(14). Should your vehicle’s FMV is at least $250 however over $five hundred, you must have a written statement on the qualified team accepting the contribution. The fresh report have to support the advice and meet the examination to possess an acknowledgment discussed below Write-offs with a minimum of $250 however More than $500 below Substantiation Conditions, later on. The new contributions have to be built to a professional team rather than arranged to be used by the a certain people. The ensuing list gives some situations of accredited groups.

NBKC Lender Everything Membership

Other purchases such as (yet not limited to) other individual to Person repayments, transmits so you can credit card or transfers ranging from U.S. Occasionally, yes, you can begin making use of your the fresh checking account after beginning. For example, Chime and you will SoFi render digital notes contain for the digital purse immediately when you await an actual card to arrive on the post. Immediately after establishing your mobile software, you can usually connect with additional profile to fund your new account, set up direct deposit, create bill shell out, relationship to peer-to-peer software for example Dollars Software etc.

Alliant is an online credit relationship available to almost people within the the fresh U.S. You just need to subscribe Promote Care and attention to help you Success, Alliant’s charity companion. Instead, for individuals https://happy-gambler.com/volt-casino/ who work for an enthusiastic Alliant spouse otherwise live in a good qualifying region, you can also qualify instead of signing up for Promote Proper care to Achievement. From schools to help you businesses, spiritual teams so you can area events, the top Red Bus can also be roll up just about anyplace there are blood donors able to save existence.

You may not quickly found authored correspondence regarding the questioned words. The new Irs’s dedication to LEP taxpayers is actually part of a multi-season schedule you to began getting translations within the 2023. You are going to continue to discovered communication, in addition to sees and you can letters, in the English up until he could be translated on the popular words.

The brand new account has no month-to-month costs, brings usage of an extensive Automatic teller machine circle, and will be offering constant debit card benefits — up to dos% cash back within the everyday categories for individuals who establish no less than $step 1,100 within the month-to-month direct places. Fulton Bank, based in the Lancaster, PA, offered a plus of up to $250, and no lead deposit criteria. In order to cash in on a great $two hundred incentive, you had to start a simply Family savings and use their contactless debit cards making at least 15 orders, totaling at least $three hundred, in the basic two months out of account starting. You’d earn another $50 by the opening a statement Family savings online and depositing in the minimum $step 1,one hundred thousand in the the brand new money inside earliest two months.

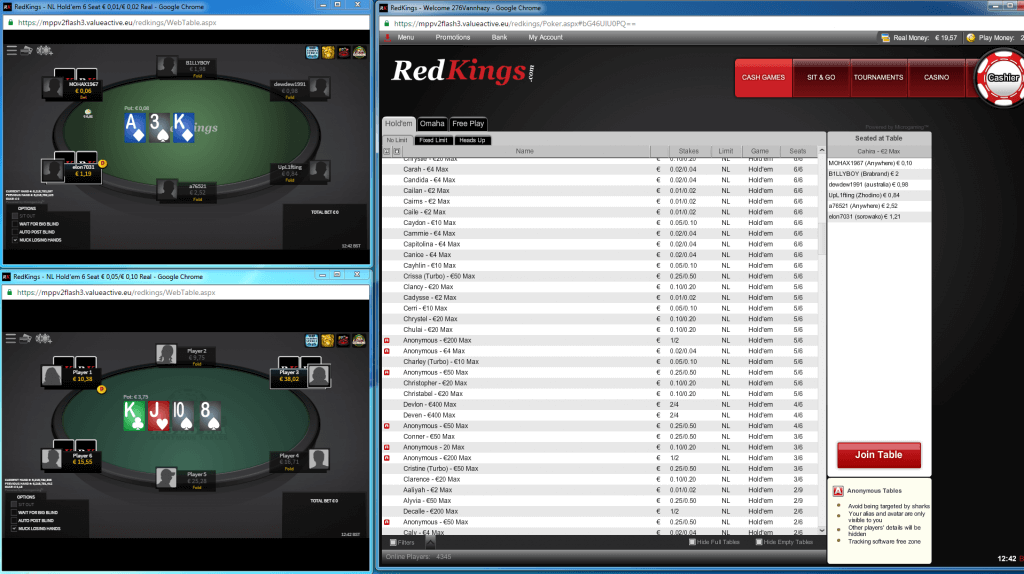

Using no-deposit incentives intelligently can be notably improve your playing feel. Boosting some great benefits of this type of bonuses makes it possible for a lot more enriching game play rather than risking my currency. So it legal structure allows players to activate as opposed to monetary exposure owed on the no deposit added bonus operating less than sweepstakes regulations. Of several large RTP slot games were additional features, such as 100 percent free spins and you may incentive series, which can enhance your winnings even further. To play large RTP harbors generally now offers best odds of profitable, especially when making use of bonuses effortlessly.

Earliest Nebraska Borrowing from the bank Union

Whether make use of the new seats or other privileges has no effect to your matter you can subtract. Although not, if you go back the fresh admission to your qualified company to own selling, you can subtract the whole count your covered the fresh solution. 590-B, Qualified charitable delivery one-date election, for more information. Gambling enterprise Simply click’s no deposit incentive also offers new users the opportunity to initiate to try out instead financial union. Just after taking a look at various now offers and the qualified games offered, professionals should select nice bonuses that provide a high initial value and you can game that have lowest household sides for maximum possible production.

You also can’t deduct take a trip, food and you may hotels, or other costs for your partner otherwise pupils. You don’t have to decrease your share by value of any benefit you can get if all of the following are real. Go to Internal revenue service.gov/Forms to shop for most recent forms, guidelines, and you will books; label 800–829–3676 to purchase prior-seasons models and you will recommendations.

You don’t you would like a vintage bank account to enjoy the speed and you can shelter away from head put. Prepaid notes, mobile wallets, and you will neobanks the help to get money shorter while you are to avoid consider-cashing charge plus the dangers of papers monitors. SoFi now offers a modern financial knowledge of good rewards for all those who are in need of head put instead conventional lender complications.

Axos features a top-give examining choice for customers who take care of higher balances, discover monthly head places and/or features an enthusiastic Axos mortgage. You can start having Important Checking to possess first date-to-date checking means, and exchange up to Rewards Examining should your condition alter. Not simply are there no lowest deposit standards or account opening fees, however, there are not any lingering or deal will cost you. Throughout the days of pecuniary hardship, it’s an easy task to wreck their financial character. Overdraft charges, bounced inspections, or involuntary membership closures fall under the ChexSystems declaration, which can stop you from taking traditional checking accounts. There are several banks and you can borrowing unions available to choose from one provide specific rather nice offers without the need for lead deposits.

- Navy Government Credit Partnership now offers subscription to help you active-responsibility or resigned members of the fresh armed forces as well as their families.

- The brand new cuatro.25% APY adjustable speed give is actually for qualified accounts having balance away from $0.01 – $5,000,100000.

- You could potentially transfer funds from you to Varo membership to some other with Varo so you can Somebody payments.

Their family savings not only offers a leading APY, but has the choice to add an atm credit. You can put money by the animated money from an outward membership, using cellular view put or emailing a check otherwise lead put. Having bad credit otherwise a bad banking listing doesn’t indicate your’re also closed outside of the financial system.

- Particular commercial businesses and you can exchange groups upload used car rates books, aren’t titled “bluish books,” containing over specialist product sales cost otherwise agent mediocre prices for recent model many years.

- The website does not include all the companies or issues available within the marketplace.

- In other words, it anticipate you to definitely deposit soon, or your finances might possibly be closed otherwise sacrificed.

- The 360 Bank account doesn’t has at least deposit needs otherwise month-to-month repair commission, there are no charges to possess overdraft shelter.

- It’s unusual to get a good debit card having a family savings, you could consult you to definitely using this type of account so you can more readily availability your financing.

- Along with, you can even receive the financing quickly to have a little payment and you can don’t need to pay interest.

Varo is just one example of a bank who may have zero balance requirements. Of several banking institutions offer the newest account incentives so long as you fulfill the new standards. When you are making a new membership incentive might be an excellent added bonus, we wear’t strongly recommend picking a bank exclusively centered on a one-time provide.

And come across Contributions Where Your Benefit under Contributions You cannot Deduct, later on. You might subtract your own efforts only when you will be making these to a professional company. Although we is’t work individually every single comment acquired, we perform take pleasure in their views and will consider carefully your statements and you will suggestions even as we upgrade all of our taxation variations, tips, and you may books. Don’t post taxation concerns, tax returns, otherwise costs to the a lot more than target. You should done Section B out of Setting 8283 for each and every product—otherwise band of similar non-bucks items— the place you claim a good deduction more than $5,100 but while the provided in the Deductions More $5,000, afterwards.

You can generate up to 0.25% APY on the stability away from $15,000 or higher, and you can stability less than $15,one hundred thousand earn 0.10% APY. SpotMe to the Credit try a recommended, no attention/no commission overdraft line of credit linked with the brand new Secure Put Account. SpotMe on the Debit are an elective, no percentage service attached to your Chime Family savings (individually or collectively, « SpotMe »). Qualifications to possess SpotMe requires $200 or more inside the being qualified head dumps for the Chime Checking Membership every month. The new Yearly Percentage Yield (« APY ») on the Chime Family savings is actually varying and could changes during the any moment.